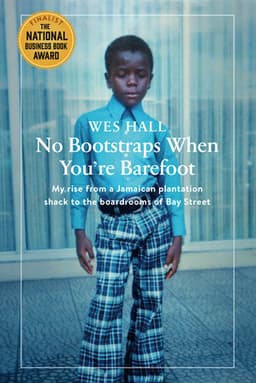

Book Review

No Bootstraps When You're Barefoot, 2022

By Wes Hall

Buy the book: https://www.penguinrandomhouse.ca/books/697265/no-bootstraps-when-youre-barefoot-by-wes-hall/9781039002371

Wesley J. Hall is a Canadian businessman and entrepreneur, recognized for his role as an investor on Canada's Dragons' Den. Originally from Saint Thomas, Jamaica, he moved to Toronto as a teenager. After studying to become a law clerk at George Brown College, he worked in the legal division of CanWest before founding Kingsdale Advisors, a shareholder services and business consultancy, in 2002. For those that are familiar with the Wes Hall of Dragon's Den but not familiar with his challenging journey, this book will be an eye opener. Wes Hall does an elegant job of covering three important topics and themes as he chronologically works through his life - first examining his own childhood - one fraught with trauma but having undeniably yielded remarkable results. Second - a history of the world of proxy filing and proxy contests and Wes Hall'sindustry contributions to it. Finally - an eye-opening examination of systematic racism that made the journey of Wes Hall all the more remarkable.

The beginning section, on Hall's up bringing, is shocking to read. Hall was forced to leave a loving grandmother for an abusive biological mother who seemed at times to take pride in hurting him. This portion is difficult to read and I was left wanting more from Hall about abuse and trauma. Too quickly, the story evolves to the classic Horatio Alger narrative of starting with less then nothing and achieving incredible things. I regretted the missed opportunity to discuss the reality of childhood trauma.

Next - in what I might describe as the most interesting business history chronicle in the book – Hall digs into the world of proxy fighting. He describes the structural elements that needed reform (how proxy contests are run for example) and how his company and vision answered the call and grew into a dominant player in the industry. For afficionados of business history, this is the best part of the book: full of interesting details about Canadian Pacific and Bill Ackman that lend drama to the technical details.

Finally, prejudice (explicit and subconscious) was a dominant theme throughout the book and deservingly so. This may be the first serious discussion in a public forum about structural racism in Canadian capital markets. Hall was unable to get a $100,000 loan to start his business, even though he had the income, home equity and career stability to deserve it. In many cases, Hall’s accent and skin colour led peers to believe he was beneath them, a lower ranking employee, when Hall was actually a rising star (earlier) and CEO (later). The financial industry is notoriously difficult to break into and to climb the ranks. Most importantly, Hall shows that to earn the respect of colleagues and peers and become a fixture is near impossible for those that don’t belong to the right clubs and have the correct relationships.

Zooming out, the historian in me craved more detail on the proxy industry. Furthermore, I believe it's unfortunate that the trauma endured by Hall becomes a glossed over narrative focused on resilience and his success came to seem inevitable and the trauma necessary. Finally - the context on the racist subculture that existed and still exists in many places in the capital markets world was eye opening and it delivers a legacy that will surely linger with readers. To Wes Hall – thank you for writing this book.

Jeremy Mosher

CBHA